You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to List

Due to the ongoing situation with Covid-19, we are offering 3 months free on the agent monthly membership with coupon code: COVID-19A

UNLIMITED ACCESS

With an RE Technology membership you'll be able to view as many articles as you like, from any device that has a valid web browser.

Purchase AccountNOT INTERESTED?

RE Technology lets you freely read 5 pieces of content a Month. If you don't want to purchase an account then you'll be able to read new content again once next month rolls around. In the meantime feel free to continue looking around at what type of content we do publish, you'll be able sign up at any time if you later decide you want to be a member.

Browse the siteARE YOU ALREADY A MEMBER?

Sign into your accountExpect Continued Economic Growth, Slower Real Estate Price Gains and Small Chance for Recession in 2020, According to Group of Top Economists

December 19 2019

WASHINGTON (December 11, 2019) -- A group of top economists arrived at a consensus 2020 economic and real estate forecast today at the National Association of Realtors' first-ever Real Estate Forecast Summit. The economists who gathered at NAR's Washington, D.C. headquarters expect the U.S. economy to continue expanding next year while projecting real estate prices will rise and reiterating that a recession remains unlikely.

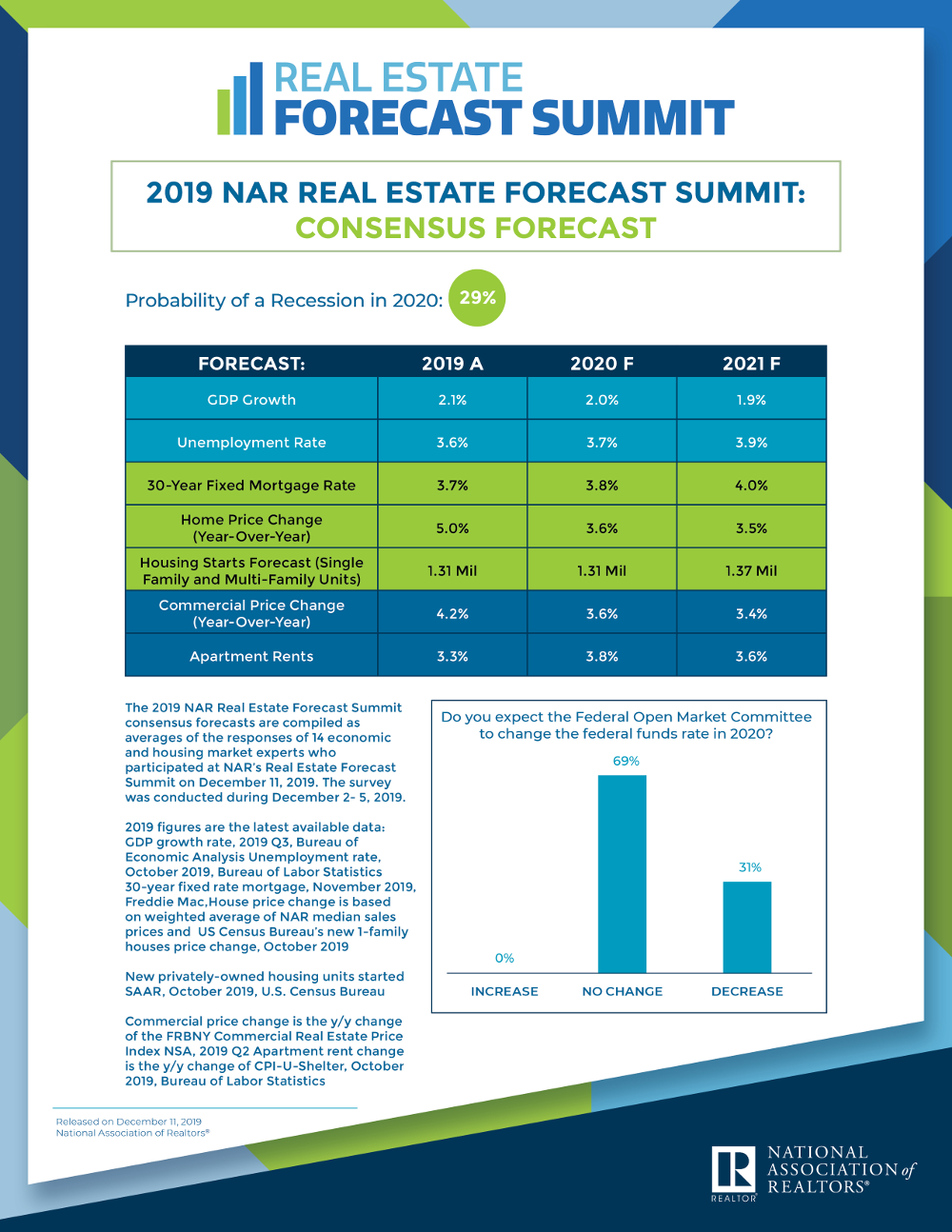

These economists predicted a 29% probability of a recession in 2020 with forecasted Gross Domestic Product growth of 2.0% in 2020 and 1.9% in 2021. The group expects an annual unemployment rate of 3.7% next year with a small rise to 3.9% in 2021.

When asked if the Federal Open Market Committee will change the federal funds rate in 2020, 69% of the economists said they expect no change, while 31% expect the committee will lower the rate next year.

The average annual 30-year fixed mortgage rates of 3.8% and 4.0% are expected for 2020 and 2021, respectively. Annual median home prices are forecasted to increase by 3.6% in 2020 and by 3.5% in 2021.

"Real estate is on firm ground with little chance of price declines," said NAR's Chief Economist Lawrence Yun. "However, in order for the market to be healthier, more supply is needed to assure home prices as well as rents do not consistently outgrow income gains."

Apartment rents are expected to rise 3.8% and 3.6%, respectively, in 2020 and 2021. According to the group of economists, annual commercial real estate prices will climb 3.6% in 2020 and 3.4% in 2021.

"Residential and commercial real estate investment remains attractive as we approach the start of a new decade," said NAR President Vince Malta, broker at Malta & Co., Inc., in San Francisco, CA. "Increased home building can serve as a stimulator for the overall economy, and we strongly encourage more homes to be built as buyer demand remains strong."

The 2019 NAR Real Estate Forecast Summit consensus forecasts are compiled as averages of the responses of 14 leading economists who participated during the summit. The survey was conducted from December 2-5, 2019.

The National Association of Realtors® is America's largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries.